Review Of VT Markets Forex Broker That Is Best And Most Detailed

In order to provide simple and transparent market access and support our clients in pursuing their financial objectives, VT Markets, a subsidiary of Vantage International Group Limited (VIG) with headquarters in Sydney, Australia, draws on more than 10 years of experience and expertise in the global financial markets. Access to international markets is made "easy and transparent" through VT Markets. The broker's accolades speak for itself. The recognitions include:

- What is VT Markets?

A well-known currency and CFD Broker, VT Markets is a subsidiary of VT Markets LLC (VIG) with operations in Australia. Through CFDs, you can access the most popular and liquid markets, including those for currency, indices, energy, metals, soft commodities, and shares. The broker assists its clients in pursuing their financial objectives and provides simple and transparent market access.

A significant Australian provider of investing and financial services, Vantage, is the parent company of VT Markets.

In order to give clients a superior trading experience, VT Markets, which was founded in 2015, has been abiding by the principle that "Innovation makes the difference" and has applied for advanced technical support in the retail FX market. This includes true ECN accounts with raw spreads, mobile trading/payments, and a potent client portal, among other things.

Read More : Forex Trading with MT4 and MT5: A Complete Guide

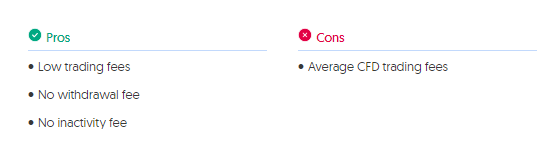

A FX and CFD broker, VT Markets is overseen by financial regulators in the Cayman Islands and Australia. Low trading fees, quick and easy account opening, and above-average email and live chat service are all features of VT Markets. The only products VT Markets offers are CFDs and forex, which is a drawback.

Additionally, there is no investment protection, and its teaching resources should be improved. Based on the evaluation of more than 500 factors and testing by opening a live account, BrokerChooser gives VT Markets a rating of 4.2/5.

VT Markets Forex Broker Pros and Cons

- Islamic Account Offered

- ZuluTrading Featured

- Good Reputation

- Negative Balance Protection

- Choice between MT4, MT5, Mobile App and Proprietary platform

- High Leverage Trading up to 1:500

- Multiply regulated broker with a strong establishment

- Competitive trading conditions

- Low Spreads

- Bonuses Available

- MT4 And MT5 Available

Cons

- Needs More Research Tools

- Only Forex and CFDs

- Demo Account valid for 90 days

- Support is not available 24/7

- No US Traders

Read More : A Guide to the Top Crypto Exchanges and Platforms

Awards

Among all the benefits, we wish to draw attention to the fact that VT Markets has not only received positive evaluations but also numerous accolades for its efficient operation and superior technology. We have been following the broker's operations for all of these years, and we can guarantee you that the broker has earned recognition. Additionally, VT Markets has received commendation from organisations that present awards in the following fields:

- BEST AFFILIATE PROGRAM – UF Awards 2022

- FASTEST GROWING BROKER – Global Brands magazine 2021

- BEST MOBILE APP – International Business Magazine 2022

For traders with little to a lot of experience, VT Markets is a good option. VT offers a swap-free Islamic account for both its Standard and ECN accounts, making it a great broker for traders who practise Islam. The platforms offered by VT Markets will appeal to traders who use the MetaTrader suite.

VT Markets Account types

Through MT4 or MT5 platforms, VT Markets provides two account types with STP and ECN execution mechanisms. Be sure to evaluate the pricing model that best suits your needs because there may be discrepancies between pricing models in addition to variations in the proposals.

Pros

- Demo Account and Live Account

- Fast digital account opening

- Islamic Swap Account

Access to trading instruments is included in the marker range, but only for CFDs and forex. Indices, energy soft commodities, precious metals, and US and UK share CFDs are examples of CFDs. The same methods used to trade major currencies are equally applicable to cryptocurrencies. However, prominent asset classes like genuine stocks or ETFs are not offered. Overall, the broker covers the most difficult markets to trade.

Customers can trade both long and short positions in some of the largest US firms starting at just $6 per trade thanks to the broker's leveraged share CFDs. Additionally, traders can benefit from leverage of 33:1, which enables them to start out with a minimal initial margin.

Australian Securities and Investments Commission (Australia) and CIMA (Cayman Islands Monetary Authority), two renowned regulatory organisations, oversee VT Markets. Transparency and a secure trading environment are priorities at VT Markets.

VT Markets Forex Broker Fees

Our analysts discovered that VT Markets pricing has some specific circumstances that may apply to various account types. These conditions also take financing fees and other fees, such inactivity, into account. Whether you select the Raw ECN or the Standard STP account will affect the price of trading at VT Markets. Nevertheless, you are receiving the market's lowest trading fees.

Trading costs are reasonable on VT Markets.

We are aware that comparing trading costs amongst forex brokers is challenging. So how did we go about making their costs transparent and comparable? By totaling up all the costs associated with a typical deal for particular products, we compare brokers.

We picked well-known instruments from each asset class that forex brokers often offer:

AUDUSD, EURCHF, GBPUSD, EURUSD, and EURUSD

CFDs for stock indices: SPX and EUSTX50

Purchasing a leveraged product, holding it for a week, and then selling it is the normal trading process. We decided on a position size for the volume of $20,000 for forex trading and $2,000 for stock index and stock CFD transactions. Our method of leverage was:

Steps for creating an account

Opening an account with VT Markets is a simple, all-digital process. The online application process takes about 10-15 minutes to complete, and our account was approved in about one business day.

The steps for opening a VT Markets account are as follows:

- Your name and contact details (phone number and email address) should be entered.

- Enter your ID number and personal information such your date of birth and place of birth.

- Include some information about your job and financial situation, such as your projected annual salary and your trading background.

- Select the base currency and account type.

- Upload copies of your passport or other government-issued identification, as well as a bank statement, utility bill, or residence certificate, to prove your identity and place of residence.

- When your account is approved, you will receive your trading account credentials.

- Fund your account lastly.

Read More : Best metatrader 4 brokers, Benefits of Trading with MT4

Deposits and Withdrawals at VT Markets

Customers of VT Markets have a number of alternatives for funding trading accounts, including local bank transfers, international bank transfers, BPAY, Skrill, Neteller, Broker to Broker transfers, POLi, fasapay, and credit or debit card payments. Customers of VT Markets can also deposit using Bitcoin.

The total rating for VT Markets Funding Methods was 8.8 out of 10. The broker offers a wide range of funding options, and there are either no or extremely minimal fees. The biggest issue is that the minimum deposit is somewhat hefty.

VT Markets is a forex and CFD broker that has garnered

attention for its comprehensive offerings and user-friendly approach, making it

suitable for both beginners and experienced traders.

Key Features and

Offerings:

1. Trading Platforms: VT Markets supports popular platforms

like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on desktop, web, and

mobile. These platforms are known for their robust charting tools and support

for automated trading via Expert Advisors (EAs). VT Markets also offers its own

WebTrader+ platform, enhancing accessibility for traders who prefer

browser-based trading.

2. Account Types: VT Markets provides a variety of account

options, including standard, Islamic, and demo accounts. The demo account is

particularly notable for its realistic trading simulation and unlimited access,

allowing traders to practice strategies without financial risk. The minimum

deposit is relatively low, starting at $100, making it accessible for

beginners.

3. Leverage and Instruments: The broker offers leverage up

to 1:500, which is high compared to industry standards. VT Markets provides

access to a wide range of trading instruments, including forex pairs,

commodities, indices, ETFs, bonds, and stocks via CFDs. However, it does not

offer options trading, which might be a drawback for some traders.

4. Fees and Commissions: VT Markets operates primarily on a

spread-based fee structure, meaning most trades do not incur additional

commissions. The broker is transparent about its fees, with no charges for

deposits but a $20 fee for withdrawals under $100. There are also no inactivity

or maintenance fees.

5. Educational Resources and Research: VT Markets excels in

providing educational content, particularly useful for novice traders.

Resources include articles, videos, webinars, and podcasts covering topics like

technical analysis, trading psychology, and risk management. The broker also

offers robust research tools, including daily market analysis and trading

signals, mainly through its partnership with Trading Central.

6. Customer Support: VT Markets offers 24/7 customer support

via live chat, email, and phone, ensuring that traders can get assistance

whenever needed. The broker’s customer service is generally well-regarded,

although it lacks phone support in some regions.

Source:

- https://www.investing.com/

- https://brokerchooser.com/

- https://55brokers.com/